Market Commentary

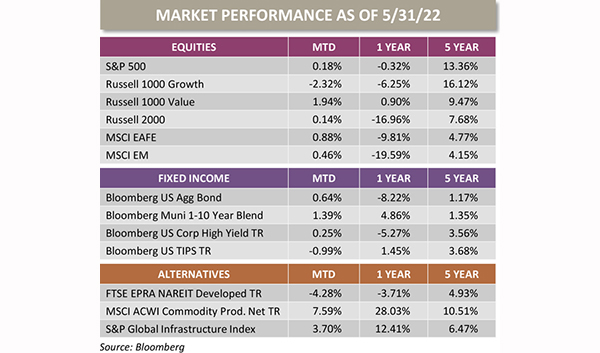

May was a tale of two halves in global markets with early month jitters giving way to late month dip buying as the narrative shifted towards peak inflation and peak Fed hawkishness. The tech-heavy NASDAQ struggled again in May while investors in quality and value oriented market segments saw positive returns.

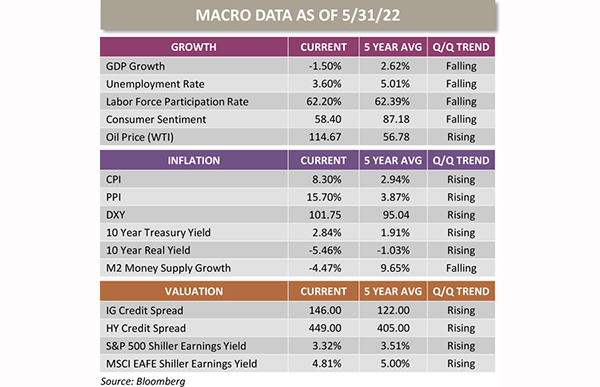

The unprecedented fiscal support following the COVID-19 crisis is fully in the rearview and monetary policy is now tightening to a degree not seen in generations. The Federal Reserve’s measures to combat inflation are beginning to bite, and investor focus should now shift towards the growth implications of tighter financial conditions. While inflation may well have peaked in recent months, the structural upward pressure on the US dollar, higher credit spreads, elevated commodity prices and a negative wealth effect all serve to further tighten financial conditions likely weighing on near-term growth.

Slowing economic growth paired with persistent inflation is generally a challenging combination for passive exposures to financial assets such as the traditional 60/40 stock/bond portfolio. Using the 10- year Treasury and Shiller S&P 500 earnings yields as proxies, the US 60/40 portfolio has a negative real expected return with inflation running anywhere north of roughly 3%.

Diversification into things like real assets, uncorrelated active strategies and businesses with positive cash flow and pricing power has never been more necessary for families looking to preserve and compound real wealth. Financial asset strategies that perform best in the “goldilocks” disinflationary growth environment that characterized the past few decades may struggle in a world of shifting growth and inflation dynamics. Our investment team strives to design balanced asset allocations capable of compounding wealth in a more macro-agnostic manner relative to traditional 60/40.

While the macro backdrop appears mixed, we can take solace in a number of items:

- Firstly, our client’s portfolios include strategies capable of performing in various market environments.

- Additionally, some supply chain disruptions appear to be ebbing as China reopens from lockdown and the world gradually adjusts to the new normal.

- Asset valuations appear more reasonable after a horrid start to 2022 as the market discounts the known challenges noted above.

- The opportunity set for non-traditional areas of client portfolios, such as Real Assets and Diversifier Strategies, appear historically attractive.

- The longer-term prospects for properly diversified portfolios are stronger now than they were 6 months ago despite the uncertain macro environment.

Creaks in Credit: A Look at Corporate Credit Conditions

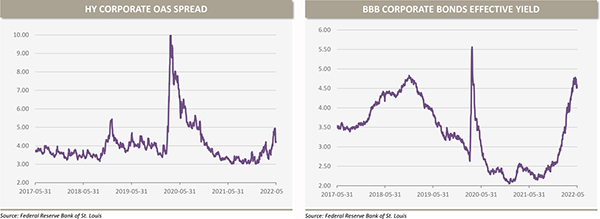

A favorite saying of market prognosticators is that the Fed “hikes rates until something breaks.” That ‘something’ generally surfaces in the credit markets with illiquidity causing spreads to widen and thus bond prices to fall. In extreme scenarios, a credit market seizure may preclude borrowers from rolling over maturing debts causing an abrupt spike in bankruptcies. Stocks seem to grab a disproportionate share of investors’ attention, but the credit markets are the foundation of the financial system. The access to and price of credit have major implications in a leveraged economy. As such, changes in borrowing rates and “spreads” are bellwether indicators of financial conditions, and sharp rises in borrowing costs can be a harbinger of economic problems.

Despite the recent challenge for stock prices, the credit markets have been surprisingly sanguine year to date. That is until a confluence of challenges have tightened financial conditions for corporate borrowers in recent weeks. Consumer sentiment continues to decline foreshadowing reduced spending, inflationary cost pressures are adversely impacting corporate profit margins and the rapid rise in Treasury rates has increased debt service costs further reducing creditworthiness of borrowers. All told, investment grade total borrowing costs have nearly doubled in recent quarters, and high-yield spreads are approaching 4Q18 levels that precipitated the “Powell Pivot” to more dovish monetary policy.

The recent creaks in credit could very well prove to be a short-lived overreaction, but equity investors are right to consider the potential implications of higher corporate borrowing costs. Specifically, higher debt service costs weigh on profitability, further compounding credit concerns. Tighter borrowing conditions may curtail or eliminate companies’ ability and willingness to execute share buyback programs; something that has been a major tailwind for stocks in recent years. Lastly, the combination of lower equity valuations and higher debt service costs could force management teams to eschew capex spending in favor of debt repayment in what is often called a “balance sheet recession.” All else equal, these factors left unchecked could weigh on near-term economic growth. Corporate credit conditions remain historically favorable despite the recent spread widening, but further percolations in the credit markets are something we are watching closely.

The above commentary represents the opinions of the author as of 6.3.22 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2206-1