“There are decades where nothing happens; and there are weeks where decades happen.” — Vladimir Ilyich Lenin

The latter half of this quote seems to be an accurate depiction of this past week. Despite Putin’s apparent façade of cooperation, Russia has launched a lethal, multi-front invasion of Ukraine.

Russia embarking on one of Europe’s largest military offensives since the Second World War raises troubling questions for investors and policymakers to consider.

- Does a passive US Administration increase the risk of further geopolitical tensions?

- Does the limited global response to the Ukraine invasion embolden Chinese aggression toward Taiwan?

- Are we witnessing the point where American hegemony dissolves into a fully “G-Zero” world order?

- What are the supply chain and energy implications of deteriorating relations with a major commodity exporter?

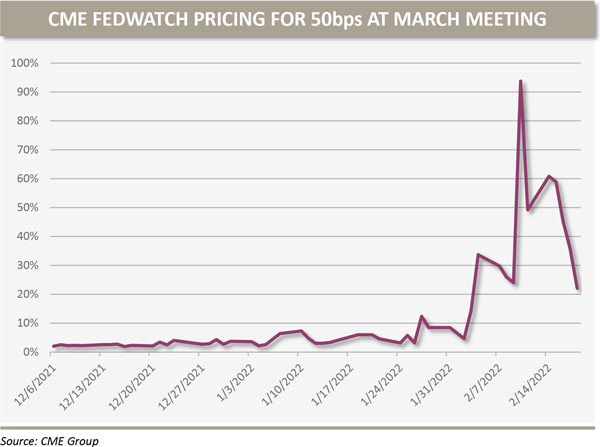

Not surprisingly, markets have been volatile as these geopolitical considerations are discounted into asset prices. Global equities are lower across the board as the uncertainty of war demands a premium and corporate borrowing costs have risen. Commodity prices, oil prices in particular, have been aggressively bid up in expectation of supply disruptions. US Treasuries have caught their usual flight-to-safety bid and expectations for upcoming Federal Reserve rate hikes have collapsed. (See chart below.) All else equal, lower rates and a flatter treasury yield curve should be a net positive for risk assets, but whether that discounting effect is enough to offset the aforementioned “war premium” remains to be seen.

Uncertainty abounds, but some of the medium-term consequences of recent developments are fairly straightforward. A world of heightened geopolitical tension, commodity price pressures, supply chain disruptions and historically-rich asset prices warrant investors to dust off their “stagflationary” playbook.

- Persistent inflation paired with low interest rates renders high-quality fixed income securities a “melting ice cube” in real terms. Futures markets imply that this dynamic is unlikely to change anytime soon. Financial repression is here and seems unlikely to abate.

- Above-average valuations and unclear growth prospects widen the dispersion of outcomes across equities. An environment characterized by large dispersion may warrant inclusion of active managers to augment cost-effective passive exposures. Additionally, risk-adjusted performance should be enhanced by tilting portfolios in favor of value, quality and defensive businesses, as well as active strategies capable of using short positions to reduce overall market sensitivity.

- After a dozen years dominated by the passive 60% stock/40% bond allocation, history suggests certain diversifying alternative strategies may be a bright spot going forward. Strategies such as managed futures and global macro should see increased opportunities for profit with high volatility in growth and inflation. Including these types of strategies is the most capital-efficient way to reduce overall portfolio risk through the power of diversification.

The range of potential outcomes in Ukraine is enormous and impossible to handicap. In these times of peak uncertainty and stress, the best response is to remain unemotional and objective when evaluating investment decisions. To that end, Oxford continues to rely on a balanced, long-term approach supplemented by systematic tilts toward areas likely to improve wealth compounding.

The Caproasia list of top 10 largest multi-family offices in the world is based on assets as reported in the Form ADV as of December 31, 2019. This list excludes multi-family offices that are operated within banking groups or a subsidiary of banking groups. The Financial Planning magazine lists of the 2020 Top 15 Firms and the 2013-2017 Top 150 RIA Firms are based on assets under management as reported in the Form ADV. The lists contain independent fee-only planning firms. Broker-dealers, insurance company affiliations and firms with substantial outside ownership stakes held by private equity firms and some outside investors are excluded. The lists do not include roll-ups, aggregators or turnkey asset management programs. To capture firms that provide true, holistic financial advice to individuals, only firms with more than 50% individual clients, as can be determined through Form ADVs, are included. The rating may not be representative of a client’s experience and is not indicative of future performance. Oxford did not pay a fee for inclusion in the rankings, but may purchase reprints. Oxford Financial Group, Ltd. is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Oxford Financial Group’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. The above commentary represents the opinions of the author as of 2.25.22 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2202-6