Strong fourth quarter returns across equities and bonds secured a significant market rebound in 2023. A combination of a dovish pivot from the Fed, modest US economic growth and easing inflation pressures increased the market’s expectation of the elusive “soft landing” economic scenario – where the Fed successfully brings down inflation without a resulting US recession or a meaningful increase in the unemployment rate. This fueled positive investor sentiment and a market rally through year-end.

The S&P 500 gained 26.3% on the year, led by the high-flying “Magnificent 7” (Apple, Alphabet, Microsoft, Amazon, Meta, Tesla and Nvidia) which accounted for 60% of the total return for the index. Highlighting how impactful these handful of stocks were to the total return, the cap-weighted index outperformed an equal-weighted S&P 500 by 12% on the year, the largest gap since 1998.

A familiar story of most of the last several years, US large growth outperformed value by more than 30% in 2023 with technology and consumer discretionary sectors leading the way. Energy, utilities and consumer staples were the only major equity sectors with negative calendar year returns in the US.

US small caps (Russell 2000) gained ground on large cap stocks during Q4 but trailed for the year with a return of 16.9%. Overseas, international developed equities (MSCI EAFE) increased 18.2% and emerging markets (MSCI EM) delivered a 9.8% return.

Fixed income markets experienced a volatile path to reasonable mid-single digit 2023 returns. Interest rates drifted higher the first nine months of the year. The predominant risk for bonds at that point was the “higher for longer” scenario – a view that the Fed was going to be forced to stay on offense with respect to inflation and keep rates at elevated levels. As new economic data began to show a shift towards a cooling labor market and declining core personal consumption expenditures (the Fed’s preferred inflation metric), there was a clear change in the market beginning in the fall.

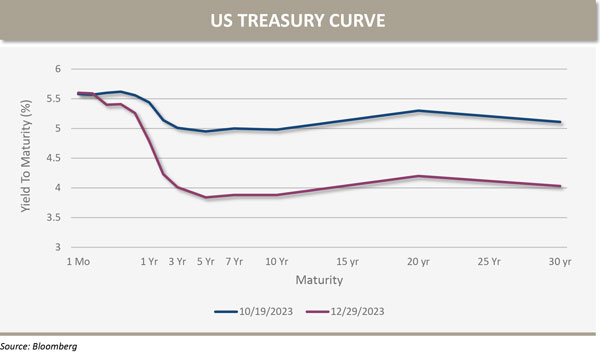

After peaking at 5.0% on October 19, the 10-year Treasury yield fell to 3.9% by year-end, nearly identical to where it started the year.

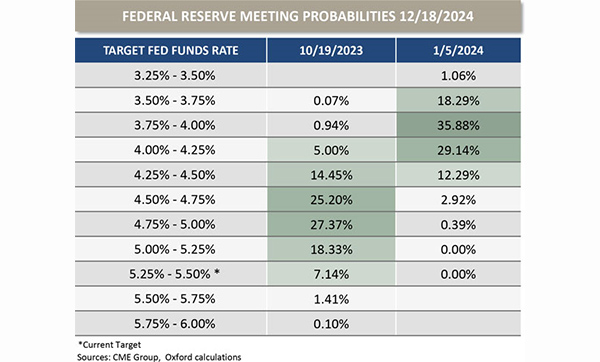

While the front end of the curve is largely unchanged over this time, the expected future path of the fed funds rate also adjusted meaningfully. The table below illustrates how futures market probabilities for the fed funds rate at the end of 2024 have evolved. The probability weighted-average fed funds rate a year from now fell from 4.79% to 3.98%.

Commodities markets struggled overall during the year. After reaching $93/barrel in early October, West Texas Intermediate (WTI) spot crude oil fell to $72/barrel by the end of December. Increases in supply from the US, which accounted for more than 50% of non-OPEC total supply growth in 2023 (according to BCA Research1) is unlikely to be repeated as the existing inventory of drilled but uncompleted wells declines.

LOOKING FORWARD

Each year countless (and mostly unpredictable) events impact markets – and 2023 was no different. From the rapid continued development of artificial intelligence (AI) and the resulting promising implications for corporate profits and efficiency to the regional bank crisis and everything in between, these events shape investor sentiment and argue against the relevance of annual market projections. To that point, according to BCA Research, 2023 was the first time in more than 25 years the average Wall Street strategist predicted a negative return from the S&P 500,1 which was not even close.

It is easy to look back and identify the specific catalysts impacting market sentiment and trends in prices. Attempting to predict these sudden changes for profit is a different matter entirely – and one that Oxford does not attempt to predict. As always, we seek to build resilient portfolios that are flexible enough to take advantage of areas of opportunity informed by our view of long-term value, which will often run counter to the market’s rearview mirror.

With that perspective as a backdrop, below is a summary of current observations as we look forward:

I. Priced to Soft Landing Perfection: The increase in equity valuations and sudden drop in interest rates indicates the market is now expecting the soft landing to occur. While that might ultimately be the case, any evidence pointing to a hard landing (recession), or no landing (re-acceleration of inflation) could lead to additional volatility in both equity and bond markets. Take advantage of recent equity market strength to rebalance to long-term strategic allocation targets.

II. Mean Reversion Opportunities: In identifying areas of opportunity, Oxford operates under a belief that valuations serve as a long-term gravitational pull on market prices. This implies a willingness to go against market sentiment, which requires patience and resolve. US small cap, natural resources, international equities and value-over-growth in US equities are all compelling from a valuation perspective relative to history.

III. Stock/Bond correlation: Periods of elevated inflation have typically been associated with a positive correlation between stocks and bonds. This means diversification benefits of a traditional stock/bond portfolio can be challenged during these times. A well-constructed allocation of Diversifier Strategies can be an excellent tool to maintain proper diversification in the current environment.

On behalf of the entire Oxford Investment Management Group, we wish you all a happy and prosperous 2024.

1https://www.bcaresearch.com/

The information contained in this report is confidential and proprietary to Oxford and is provided solely for use by Oxford clients and prospective clients. The opinions expressed are those of Oxford Financial Group, Ltd. The opinions are as of date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. OFG-2401-19