Private equity (PE) is a difficult asset class to benchmark, but by every available measurement it has produced excellent returns over long periods of time. The most recently available Cambridge Associates LLC U.S. Private Equity Index as of December 31, 2022 shows a 10-year pooled horizon Net IRR of 17.23% and a 15.29% Net IRR over 20 years. This has significantly outpaced the public market equivalent returns of the various public indexes, for example:

- Beating the Russell 3000 by over 448 basis points over 10 years

- Beating the Russell 3000 by over 550 basis points over 20 years

- Beating the MSCI World by 866 basis points over 10 years

- Beating the MSCI World by 746 basis points over 20 years

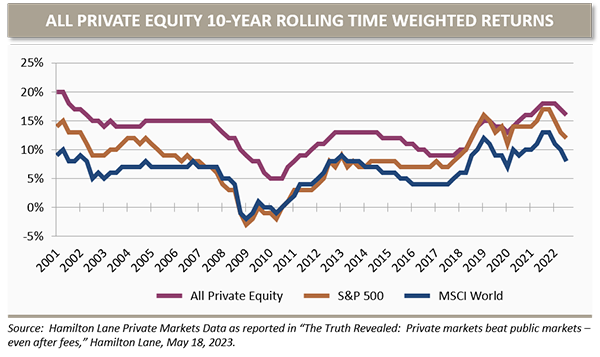

The gap between public and private equity performance, as shown in the chart below, may narrow at times such as during the most recent bull market. However, the public markets are rarely able to keep pace for long.

Private equity firms need to maintain this outperformance or else their investor base would soon shift to more liquid, lower cost investment options. The challenge has only increased as more capital has flooded private markets and driven up the price of private companies. But private equity firms have transformed themselves over time to meet this challenge.

Components of PE Performance

At the most basic level there are three ways to increase the value of a portfolio company investment:

1. Use leverage at acquisition and then use free cash flow to pay down debt over time and thereby increase the value of the equity

2. Grow the company’s revenue and earnings

3. Increase the multiple of earnings that the next buyer is willing to pay

Today the old stereotype that PE is just about financial engineering through excessive leverage is mostly a memory. To be sure, leverage is still part of most buyout transactions and PE firms continue to utilize it with varying degrees of prudence. But you can’t outperform in today’s market through financial engineering alone1. The best performing PE firms focus on #2 and #3. Achieving multiple expansion is an unpredictable process, but there are certain inflection points where buyers will often pay more. Successful PE firms find that they can hit these inflection points using a repeatable playbook to grow and scale a company while upgrading its infrastructure and processes.

Today PE succeeds through a combination of financial, governance and operational improvements. On the financial side, this starts with negotiating better terms with lenders and suppliers. But more importantly, PE firms unlock capital investment that a concentrated founder is unable or unwilling to do on their own. This capital makes it possible to accelerate both organic and inorganic growth.

Governance is a key area of professionalization for most portfolio companies. PE firms augment and upgrade management teams, build out an experienced board of directors and establish sophisticated financial reporting systems & processes so that management and the board are governing by data instead of by feel. Establishing an annual budgeting process and monthly key performance indicators increases accountability and allows the board to prioritize value creation projects. Effective governance lets a company make measurable progress towards key priorities and go from one success to another.

For many years PE firms could achieve success with financial and governance transformation alone. But as the market has become more competitive, today it takes more. Operational improvement is the biggest change in the PE world over the past twenty years. PE firms are becoming more specialized with specific end-markets or business models. PE firms today bring significant operational and strategic resources (both internal and external) to bear on their companies, and they get them involved earlier in the process. Where it was once sufficient to buy a company and then take 6 to 12 months taking stock of what they had, today it is a critical to hit the ground running. The integration of operational resources into investment deal teams provides more actionable opportunities for growth.

Financial, governance and operational levers are being used at all levels of private equity, but they are most compelling in the middle market and lower middle market. At Oxford we focus on lower middle market PE firms because there is more opportunity to impact transformational change in these areas at smaller businesses. While no company is completely immune to market headwinds, note that many of these improvements can still be executed despite broader macroeconomic conditions. The long term outperformance of private equity is a result of this systematic business building.

1Historically so-called “Leveraged” Buyout Transactions were financed with anywhere from 60 to 90 percent debt. As late as 2007, prior to the Global Financial Crisis, the average debt to capitalization ratio for U.S. buyout transactions was 68%. However since that time the ratio has generally been below 60% and in recent years has stayed in the mid-50s. See Kaplan & Stromberg, “Leveraged Buyouts and Private Equity,” Working Paper 14207, National Bureau of Economic Research, July 2008 and McKinsey Global Private Markets Review, 2021 and 2023.

The information in this presentation is for educational and illustrative purposes only and does not constitute tax, legal or investment advice. Tax and legal counsel should be engaged before taking any action. The information in this presentation is for educational and illustrative purposes only and does not constitute tax, legal or investment advice. Tax and legal counsel should be engaged before taking any action. OFG-2212-13 Oxford Financial Group, Ltd. is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Oxford Financial Group’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. The above commentary represents the opinions of the author as of 1.12.23 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2306-12

**As of 12.1.21

***As of 8.1.22