The market narrative appears to be approaching a crossroads after an oddly sanguine few months. The hopeful chatter of a “Fed Pivot” now seems starkly at odds with inflation and employment data.

Despite the fastest pace of interest rate hikes in a generation, the Bureau of Labor Statistics recently reported that the American economy added 517,000 jobs in January, the largest positive surprise versus expectations on record. In fact, the US unemployment rate actually ticked down to 3.4% in January in spite of the Fed’s best efforts to cool the economy.

While low unemployment is usually something to be celebrated, this recent labor market strength is not a welcomed sign for a Federal Reserve focused on returning inflation to their 2% target. With a seemingly strong labor market and national wage growth annualizing at north of 5%, inflation is unlikely to subside to a satisfactory level for Fed officials.

Signs of inflation becoming entrenched emerged last week when the US Consumer Price Index ticked up to 6.4% shattering hopes of a slow and steady grind back to 2%. The hot CPI report was followed a few days later by the Producer Price Index, viewed by many as a leading indicator of inflation, also coming in well above expectations.

Barring a material softening in wage growth and employment, it seems unlikely that the Fed will be successful in returning inflation to more normalized levels. Chair Powell told us as much at his Jackson Hole speech last summer where he spoke of requisite “pain” in order to tame inflation.

The uncomfortable reality is that recent data is telling the “data-dependent” Fed that the job is nowhere near done. In order to achieve their price stability mandate, it appears that the Fed will be forced to hike interest rates higher and hold them there longer than the market is currently anticipating. Markets will need to “price-in” this fact in the near future which will likely engender further asset price volatility.

Strategies for Uncertain Times

The Oxford Investment Fellows™ strive to build portfolios offering robustness to any number of macroeconomic environments. A potential blind spot for more traditional approaches is a period of heightened volatility in growth and inflation. Specifically, periods of high or rising inflation paired with tepid economic growth present challenges for both stocks and bonds, as we saw in 2022.

There are, however, a limited number of “divergent” strategies tailor-made to capitalize from these painful market dynamics. Such Diversifier Strategies actually tend to benefit from high and rising market volatility – a valuable feature in a portfolio context.

One such divergent strategy well positioned for an uncertain future is Systematic Trend Following. We published a timely piece on the strategy here, and we maintain strong conviction in this valuable Diversifier.

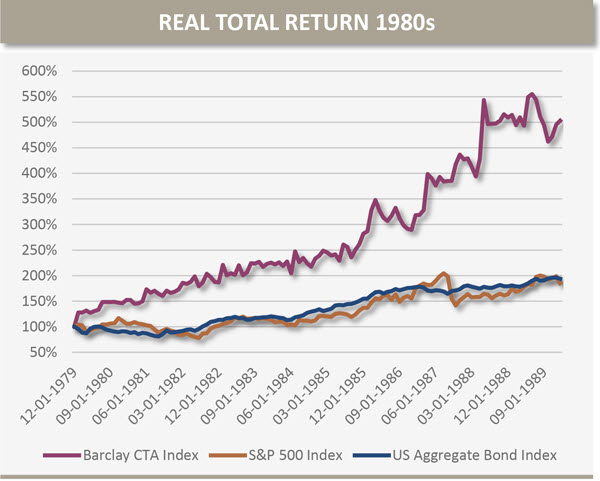

A useful historical parallel was the 1980s, when inflation was high and volatile, and growth was challenged. The below visual tracks the real (i.e., inflation-adjusted) performance of the Barclays CTA Index (an index of trend following funds), the S&P 500 and the US Aggregate Bond Index over that frustrating decade. History strongly suggests that maintaining exposure to Diversifier Strategies is prudent with the current macro backdrop.

The information in this presentation is for educational and illustrative purposes only and does not constitute tax, legal or investment advice. Tax and legal counsel should be engaged before taking any action. OFG-2212-13

Oxford Financial Group, Ltd. is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Oxford Financial Group’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. The above commentary represents the opinions of the author as of 1.12.23 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2302-10