In the summer of 2021, we debuted our Partner’s Fund. Since that time, the Regent Street team has reviewed over 750 unique private equity (PE) funds and over 400 Co-Investments in our target market and closed 14 limited partner (LP) fund commitments and 15 Co-Investments. Our exposure and activity give us a unique perspective on recent dynamics in private equity capital markets. Below we outline those dynamics and highlight how we are able to play to our strengths in a complex environment.

The last few years have been some of the most difficult for raising capital as an Emerging Manager. Most of the dollars raised in the market are going to a minority of managers that are raising larger (>$1 billion) funds. This dynamic has further exacerbated the shortage of LP capital for smaller and younger managers.

Regent Street has a highly focused strategy. We build a portfolio of limited partner private equity fund investments with the goal of long-term capital appreciation. We source 250-300 unique opportunities a year to make 4-6 commitments to Emerging Managers with a sector specialty executing buyout and/or growth equity transactions in the US lower middle market. We do so through our Partner’s Fund vehicle. These managers are typically raising one of their first funds with less than $1 billion in assets under management; the majority are between $200 and $750 million. We actively seek to co-invest alongside managers in their best investments as well.

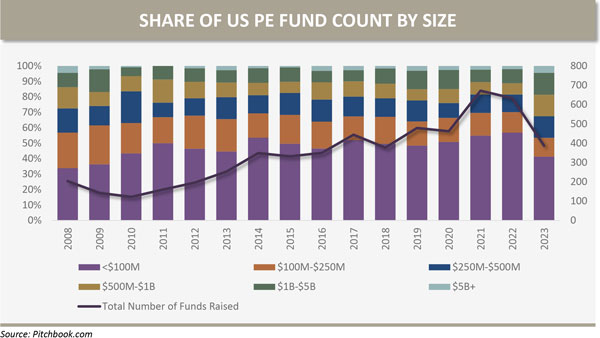

In the first graph below, we show the % share of US PE funds by size. That is, the total number of funds raised, sorted by size, in a given year. This graph shows that ~80% of funds raised, raise less than $1 billion. However, since 2021, a higher proportion of the funds that have been raised have raised more than $1 billion. At the same time, the total number of funds raised has decreased significantly. This means fewer small and young funds have been raised and capital is concentrated in the larger end of the market.

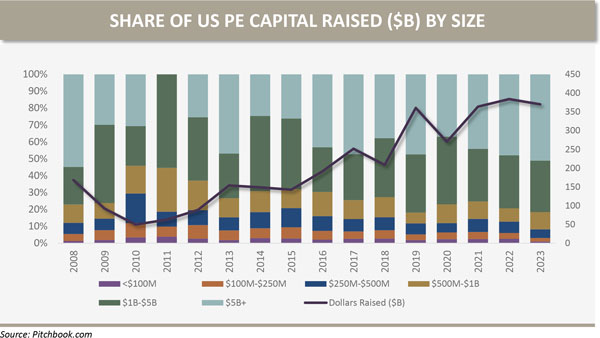

The second graph below further highlights this trend. Although funds with more than $1 billion are ~20% of the total number of funds raised, they represent ~80% of the total dollars raised by private equity funds. This means that even though most funds raised are less than $1 billion, most capital goes to the relatively few firms that are raising more than $1 billion. During periods of higher volatility, the largest market participants (pensions, sovereign wealth funds and large endowments) will often pull back on allocations to private equity and the remaining dollars will be concentrated in larger, more established firms. This leaves a dearth of capital at the end of the market where Regent Street hunts.

The Regent Street strategy is unique in that we can support a manager across a wide breadth of their life cycle. We are both a fund and a co-investor; we can anchor a fund (be one of the first investors into a fund) and we can invest with a manager over multiple funds. Our sophistication and flexibility mean we bring more than just capital when we invest. Our strategy positions us to be a value-added partner.

Oxford’s focus on the smaller end of the market means our capital is more important to the managers with which we invest; our sophisticated underwriting allows us to determine which managers have a definable edge; and our flexibility makes us an ideal partner to Emerging Managers. The difficult fundraising market plays to our strengths and makes our capital even more valuable.

The information contained in this report is confidential and proprietary to Oxford and is provided solely for use by Oxford clients and prospective clients. The opinions expressed are those of Oxford Financial Group, Ltd. The opinions are as of date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. OFG-2406-10