By: Susan Hagley, MST

Senior Wealth Strategist

There are many charitable giving vehicles available to help you carry out your philanthropic goals. Two of the more commonly used options to consider are a Donor Advised Fund or a Private Foundation. Both will allow you the opportunity to be more strategic with your charitable giving and to create a philanthropic legacy for your future generations.

In this first email in our two-part series, we will discuss Donor Advised Funds. Understanding the distinct advantages and drawbacks is the key to deciding which vehicle is best suited for your circumstances and goals.

Basics

A Donor Advised Fund (DAF) is a giving account that is housed in a public charity (the sponsoring organization). Donor Advised Funds are a simple and efficient way to make a charitable impact. Donors may contribute assets and receive a current year income tax deduction. The funds can then be invested and grow tax-free while the donor has flexibility to recommend grants to charity over time. This provides families with time to develop a thoughtful giving plan.

Setting up a DAF involves selecting a sponsoring organization (such as a national nonprofit or a community foundation) and completing their requisite form or application. There is generally no cost involved in opening a DAF and it can typically be established and ready in a few days. Once the DAF account is open, the donor makes an irrevocable gift that cannot be returned or used for any purpose other than grantmaking to charities.

Administration

Once established, the sponsoring organization handles the administrative work at a low cost. This includes managing investments, record keeping, tax receipts and grant administration. The donor retains advisory privileges to make grant requests and, in some cases, select an investment advisor. Sponsoring organizations typically have suggested minimum payouts and limits on the length of time without any grants being made. They may also require a grant if the overall fund did not meet its total required payout.

Grantmaking

Donor Advised Funds are required to give to 501(c)(3) public charities. Therefore, they are not able to make grants to private foundations or individuals, such as for scholarships or hardships. They also may not make grants to fulfill multiyear pledges. The DAF sponsoring organization handles the due diligence related to grantmaking. The donor may request grants to specific public charities. Then, the sponsoring organization is responsible for reviewing the grant requests and must approve them before they are made.

Privacy

DAFs provide donors with the ability to make anonymous grants, providing privacy if that is desired. This can be accomplished because DAFs do not have an annual filing requirement, so names of individual donors are not disclosed to the public. In addition, a gift can be presented to the charity disclosing only the name of the sponsoring organization.

Contributions and Asset Selection

When making any gift, asset selection is an important consideration. Ideal assets to gift to a DAF are long-term appreciated securities, especially those with low basis. This is the most tax-efficient method because securities that have been held for more than one year can be donated at their fair market value and it eliminates the capital gains tax on the sale. It also maximizes the charitable dollars available because the DAF is not subject to tax.

The most common assets to gift to a DAF include cash, publicly-traded securities and mutual funds. However, some donors desire to gift complex non-cash assets, such as non-publicly-traded stock or an LLC interest. Key considerations when donating complex assets include whether the supporting organization will accept the asset, if it can be transferred and liquidated, how long the process will take, how soon liquidity is needed and how much an appraisal will cost to determine the fair market value.

Family Engagement

To engage the next generation, donors may wish to create a Legacy Plan for their DAF. Typically, donors act as the primary advisors and appoint their children or loved ones as secondary advisors. Depending on the sponsoring organization, other succession options may include dividing the DAF for individual successors, naming charities as beneficiaries to receive the remaining assets or endowing a DAF to continue making grants to designated charities for a period of time. The Legacy Plan may also include a Family Philanthropic Mission Statement. This allows donors and families to communicate charitable intent and provide guidelines for grantmaking.

Income Tax Deductions for Taxpayers who Itemize Deductions

Charitable giving is not only a generous and compassionate act, but it also can be an effective tax strategy. Donors who itemize their deductions on their income tax return may qualify for a charitable contribution deduction. The tax deduction is limited to a percentage of your AGI and contributions that exceed these limitations can be carried over in each of the next five years until used.

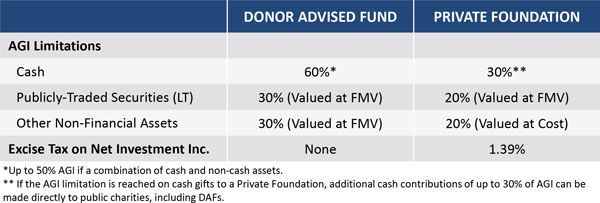

DAFs and private foundations are subject to different tax treatment, summarized below. In years you donate a significant portion of income to charity or have a highly appreciated asset to contribute, you may receive a larger tax benefit through the use of a DAF.

Conclusion

Part 2 of this series will discuss private foundations to further help you understand which charitable vehicle may make sense for your family.

The information contained in this report is confidential and proprietary to Oxford and is provided solely for use by Oxford clients and prospective clients. The opinions expressed are those of Oxford Financial Group, Ltd. The opinions are as of date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. OFG-2401-35