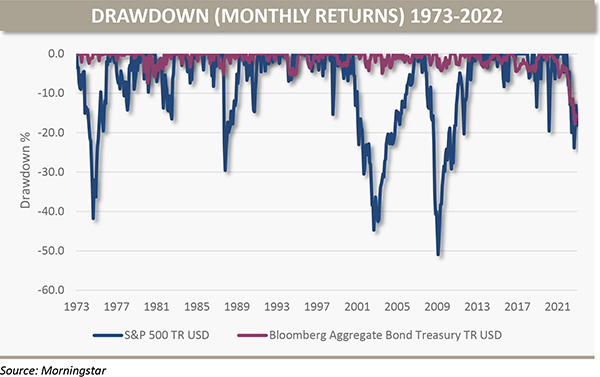

The -18.1% return for the S&P 500 in 2022 was the fourth worst calendar year return for the broad US large cap equity index since 1973. During challenging equity markets over the past 40+ years, diversified investors that held stocks and bonds benefited from the counterbalance of a bond portfolio that was largely uncorrelated to stocks, or even better, negatively correlated at times. A secular decline in interest rates helped dampen equity volatility and provide a lift to portfolio returns.

Investors felt no such comfort from their fixed income portfolios during 2022 as interest rates moved sharply higher. In fact, this last year saw the steepest drawdown for fixed income in well over 50 years (including the late 70’s/early 80s period when Fed Chairman Volker famously battled inflation in the US). A traditional 60% S&P 500 / 40% Bloomberg Agg Bond Treasury portfolio experienced its worst return since the depths of the Financial Crisis in 2008.

Returns within developed non-US equities fared much better than US counterparts during the year. However, for US-based investors the unrelenting strength of the US dollar masked the outperformance. The MSCI EAFE Index local currency index returned -7.0% in 2022. The same index in USD including the currency impact was -14.5%.

A lone bright spot for traditional markets was real assets, specifically commodities. The Bloomberg Commodity Total Return Index gained +16.1%. Upstream commodity producers continued to benefit from a combination of rising commodity prices and historically cheap valuations.

INFLATION FIGHT

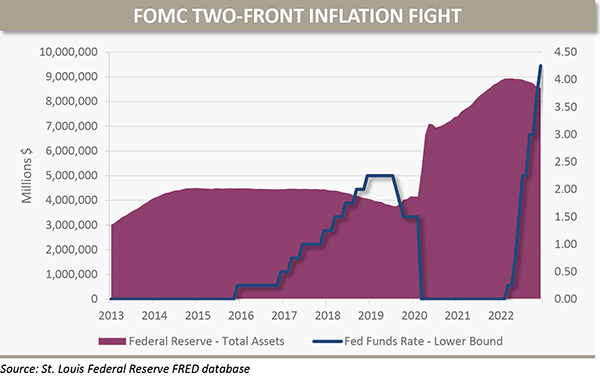

The Federal Reserve raised the fed funds rate by 4% over the course of 2022 in an effort to tame inflation that had moved well past the “transitory” kind (short-term supply chain issues) referenced in earlier FOMC meeting minutes. Today we face a stickier and more entrenched variety that emerged within wage growth. Beyond raising rates, the Fed is allowing its balance sheet, which had ballooned to $9 trillion following massive stimulus during the COVID-19 pandemic, to shrink by no longer reinvesting maturity proceeds, effectively removing a massive (and price insensitive) buyer from the market.

While anecdotal evidence of peaking inflation are beginning to show (headline and core CPI fell year-over-year and month-over-month in November), it is clear that policymakers are determined to keep a lid on inflation, even as equity markets struggle. Said differently, it appears the “Fed put,” a belief that the Fed will rescue markets with easing monetary policy, is dead.

On the positive side, breakeven inflation rates, which project the market’s expectations for future inflation, remain contained and are falling. This suggests the market anticipates the current path of monetary tightening will work. Whether the fight against inflation will lead to an economic contraction remains to be seen, though “soft landing” optimism of inflation falling towards the target 2% rate without a US recession seems remote. The bond market certainly does not subscribe to this optimism with a majority of the Treasury yield curve inverted, a condition that historically foretells a recession within 12-18 months.

LOOKING AHEAD

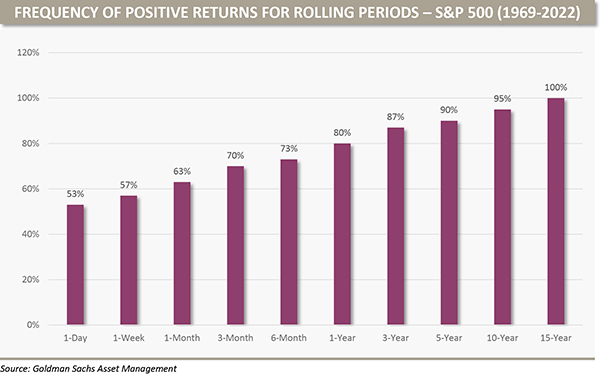

While it might seem overly simplistic, it is worth noting that expected future returns increase with falling equity valuations and rising interest rates. It can be emotionally difficult to live through volatility, but remembering this core tenant along with maintaining a patient, long-term view can help maintain a rational perspective.

Oxford’s portfolio construction philosophy is not contingent on making market timing decisions or attempting to predict recessions or when interest rates will fall/rise. Observing how routinely and far off well-resourced and sophisticated research firms are with their annual market predictions is enough evidence to support this view. Instead, we attempt to build portfolios that are robust to various outcomes while leaning into areas of opportunity and away from uncompensated risk.

As we enter 2023 and face heightened economic uncertainty, below are a few observations:

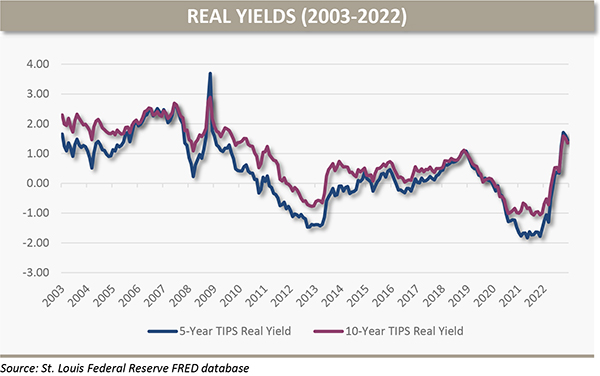

I. Real yields are real again. Fixed income markets enter 2023 with the most attractive environment in years. Real yields (net of expected inflation) are the highest since 2009. Investors have access to strong absolute yields within portions of securitized bonds and high-yield municipal bonds, along with other areas of fixed income.

II. Higher rates are letting the air out of growth stocks. The move higher with interest rates appears to be the catalyst for a shift in speculative behavior and relative performance between growth and value stocks. The “meme stock” craze is over. The Russell 1000 Value index outperformed the Russell 1000 Growth index by 21.6% in 2022. Importantly, the historical valuation spread between value and growth is still wide by historical measure.

III. International stocks – two ways to win. US equities have significantly outpaced international stocks for more than ten years. It can be tempting to throw in the towel and embrace the home bias, but we believe a global approach to equities is appropriate. While timing is uncertain (see comment above!), there is a meaningful valuation advantage in favor of international markets. Additionally, any weakness in the US dollar would be an additional tailwind.

IV. Value of Diversifiers. When downside volatility emerges at the same time correlations rise between stocks and bonds, the importance of other strategies that can provide more durable diversification increases. Oxford’s approach to constructing a thoughtful portfolio of Diversifiers was tremendously accretive in 2022. This allocation offered a unique return stream not directionally tied to equities or fixed income in aggregate. Importantly, we view this allocation as strategically important across market cycles. In other words, while the value to portfolios was most evident in a year like 2022, this allocation has merit when traditional markets are performing well.

V. Private Markets Discipline. The ability to create long-term value without concern for analysts’ quarterly earnings estimates is particularly helpful during times of elevated equity market volatility. A disciplined, consistent, vintage year approach to private equity commitments is as important as the effort to identify attractive individual opportunities.

On behalf of Oxford’s Investment Management Group, we wish you a happy and prosperous 2023.

Oxford Financial Group, Ltd. is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Oxford Financial Group’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. The above commentary represents the opinions of the author as of 1.12.23 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2301-10

**As of 12.1.21

***As of 8.1.22