It is well documented that investors’ behavioral biases negatively impact their returns over time. Morningstar publishes an annual report which helps quantify just how harmful these behaviors have been to investor returns. Morningstar’s most recent update, “Mind the Gap 2024,” features a headline reading, “Investors lost out on about 15% of the returns the fund generated.” It is critical for investors to understand the reason this gap exists. Thoughtful and disciplined investors pursue strategies to eliminate the gap, or even turn it to a positive.

Each year, Morningstar compares dollar-weighted returns (which account for investor cash flows into and out of funds) to time-weighted returns (which assume a constant investment over the entire period). In 2024, the average fund’s time-weighted return was 7.3% over 10 years, while the average investor’s dollar-weighted return was 1.1% less. The “return gap” of 1.1% is a result of investors’ poor timing of their purchases and sales. Investors tend to overreact to short-term performance and sentiment, buying assets which have performed well and selling underperforming ones. In cyclical markets, these actions prove to be detrimental to long-term performance. The return gap was negative in each of the past ten calendar years, highlighting the persistence of investors’ poor timing decisions. The gap was largest in 2020 at over 2%, in the midst of Covid-related market volatility.

The greater the volatility in markets or individual strategies, the larger the negative return gap has been. Morningstar reviewed thematic funds in late 2023 in a piece titled “The Big Shortfall: Thematic Investors Lose Lion’s Share of Returns Due to Poor Timing.” There has been an explosion in thematic fund launches in recent years focused on innovative areas such as clean energy, electric vehicles, artificial intelligence and life sciences. These funds present attractive narratives that asset managers can easily market. Often, stocks in these compelling themes trade well above their fundamental value, driven by investors chasing performance. Corrections can be significant when fundamentals fail to match the expectations priced in and sentiment shifts. This volatility magnifies the negative impact of the return gap. A review of thematic funds in 2023, highlighted that while the funds earned 7.3% over the prior five years, the return gap was 4.9%, reducing investors realized returns by over two-thirds.

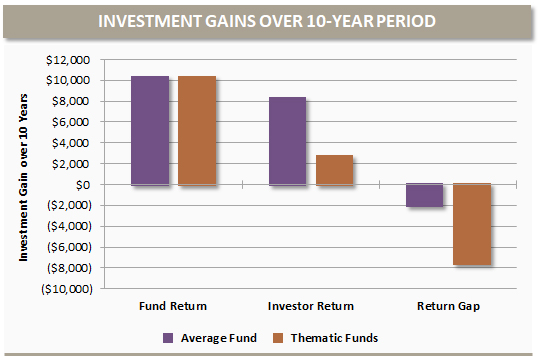

The impact of this return gap is significant when compounded over longer periods. As an example, the investment gain on $10,000 invested over ten years at the average fund return of 7.3% is highlighted below. A buy and hold investor in the funds would more than double their initial investment. The average actual investor, by compounding returns at a 1.1% lower rate, earned 19% less in investment gains over ten years. For Thematic Fund investors, the 4.9% return gap compounded over 10 years would result in investment gains which are 74% lower.

Source: Morningstar, Oxford Calculations

Reducing the Return Gap

It’s critical for investors to pursue strategies to avoid the return gap. The following are strategies Oxford implements to avoid the return gap or, even better, benefit from other investors’ short-term reactions to achieve a positive return gap:

Rebalancing: Systematically rebalancing imposes a discipline precisely the opposite of the behavior of the average investor which causes the negative return gap. When investors rebalance their portfolio to targeted allocations, they purchase more of the underperforming funds and sell those which have outperformed. Acting contrary to the actions which cause the negative return gap should result in a positive return gap or returns that exceed the performance of the underlying fund.

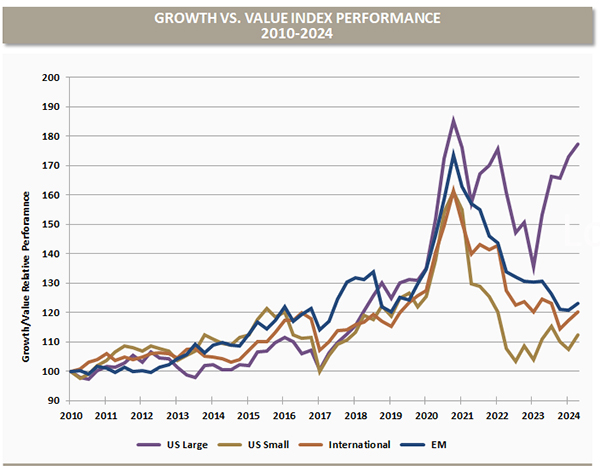

Style Diversification: Rebalancing is particularly effective with investment strategies which are complementary. Growth and Value are two such styles. While Value has outperformed over the long-term, Growth has led markets since 2010 across regions. The volatility of the relative performance makes rebalancing particularly compelling.

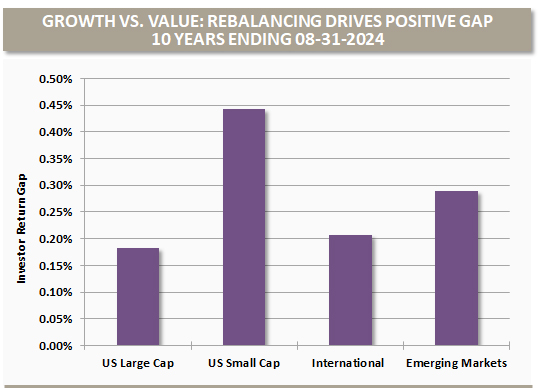

We simulated a buy-and-hold portfolio with a 50% Growth Index/50% Value Index in each asset class. An annually rebalanced portfolio adds 0.18%-0.44% per year over ten years relative to a buy and hold approach. Rebalancing effectively turns the return gap from a negative to a positive for investors through a disciplined and contrarian process. Oxford seeks complementary strategies in each asset class to maximize the benefit of rebalancing.

Source: Morningstar, Oxford Calculations

Limit Turnover: Investors should be cognizant of the negative impact of portfolio changes and aim to limit turnover. Behaviorally, it’s easier for investors to add to strategies that have been working well or sell investments that are out of favor. We view a long-term time horizon as one of the most compelling advantages in markets. We seek managers who are comfortable being out of favor in the short-term in order to capture long-term outperformance. We’ve observed that even managers with the strongest long-term track records typically outperform in the short term just over half of the time. The best time to add to these managers is after a period of short-term underperformance. Investment styles tend to revert to the mean. Buying high-quality strategies when they are out of favor or selling/reducing when in favor is an excellent way to turn the return gap positive.

The following excerpt is from Roger Federer’s commencement speech at Dartmouth in June: “In tennis, perfection is impossible. In the 1,526 singles matches I played in my career, I won almost 80% of those matches. What percentage of points do you think I won in those matches? Only 54%. Even top-ranked tennis players win barely more than half the points they play. When you lose every second point on average, you learn not to dwell on every point.”

This lesson is very important in investing as well. Investors who “dwell on every point” tend to negatively impact their long-term returns. Markets are increasingly likely to overshoot fundamental value on both the upside and downside for a number of reasons. Passive funds, which represent an increasingly large share of the market, buy and sell without consideration of fundamental value. Speculative short-term trading is increasingly prevalent driven by the influence of social media. In highly volatile markets with prices increasingly disconnected from fundamental value, active investors have substantial opportunities. However, for emotional or undisciplined investors, the return gap can be a significant drag on returns.

The information contained in this report is confidential and proprietary to Oxford and is provided solely for use by Oxford clients and prospective clients. The opinions expressed are those of Oxford Financial Group, Ltd. The opinions are as of date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. OFG-2409-32