NICE is an acronym coined by former Bank of England Governor Mervyn King to describe the “non-inflationary continuous expansion” experienced by the UK economy in the 1990s. With the benefit of hindsight, we could say that the last four decades were “NICE” for global investors. Commentators would struggle to find a better adjective to characterize a 15% decline in treasury yields and near 40-fold increase in the stock market since the early 1980s. NICE indeed.

This remarkable period experienced by the last few generations of investors could be attributed to a range of factors including:

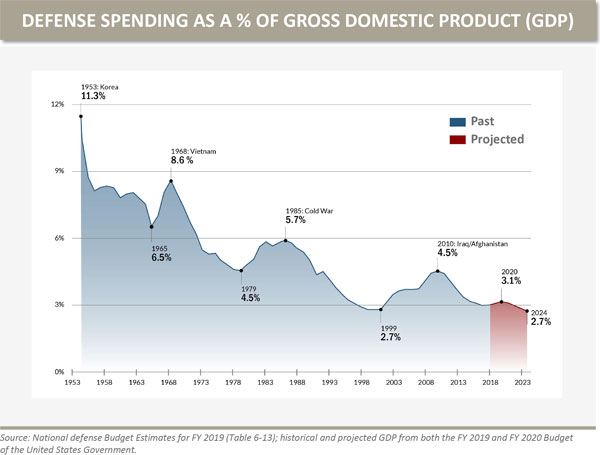

- The so-called “peace dividend” upon the dissolution of the Soviet Union and the end of the Cold War. The opening of a unipolar world allowed supply chains to lengthen and global specialization to flourish to a degree never before seen. A less hostile world freed up fiscal capacity as US defense spending fell from 5.7% of GDP in 1985 to 2.7% today.

- The disinflationary impact of China opening to the global economy resulted in a massive rise in Chinese labor productivity which drove a 44-fold increase in Chinese per-capita GDP since 1981. China quite literally exported disinflationary growth to the world by nature of mercantilist policies and low-cost production.

- Technology similarly enhanced productivity in a non-inflationary manner with the advent of the internet, email, cellular telephones and ever-expanding computing power.

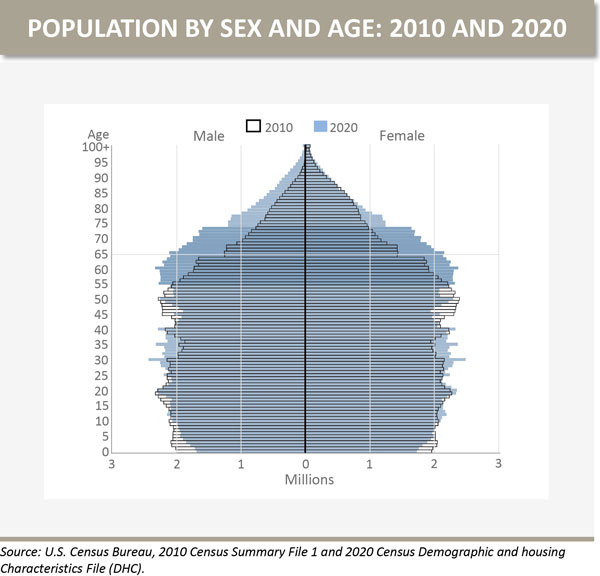

- Demographics were conducive to non-inflationary economic growth as the bulk of the demographic distribution was employed with the labor force participation rate peaking in the late-1990’s.

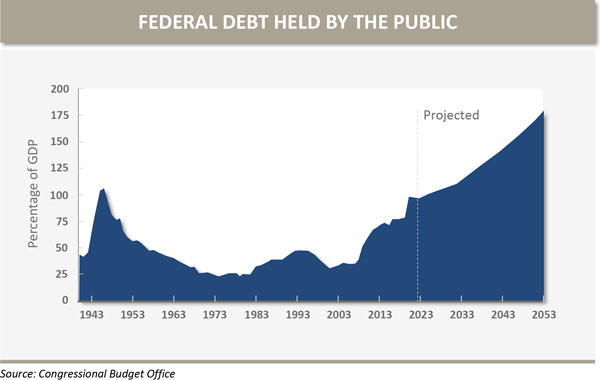

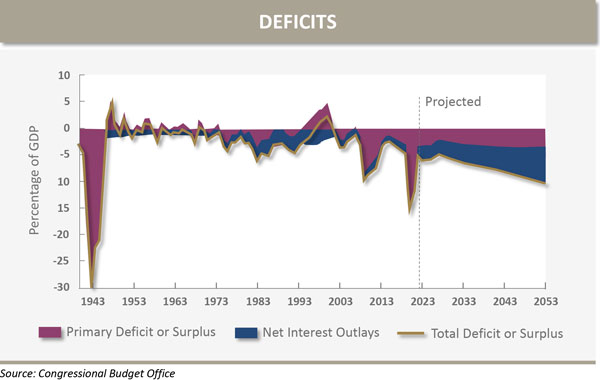

- Debt and deficits were comparatively low allowing for traditional monetary policy to influence the business cycle through adjustments to the cost of capital in a largely credit-driven economy. More to this point, the abovementioned disinflationary forces were so strong during the NICE years that central bankers became conditioned to quickly intervene in times of market stress with essentially no immediate negative repercussions.

The above list is just a small smattering of the macroeconomic forces that suppressed inflation and simultaneously turbocharged global productivity and economic growth since the early 1980s, resulting in an unprecedented boon to asset owners.

A several decade period of stable inflation and growth was a historical anomaly, and it took a confluence of forces, many of which are unlikely to be repeated, to create the NICE years. In fact, several investor-friendly structural forces are beginning to show signs of reversing themselves.

Specifically:

- The apparent shift towards geopolitical multi-polarity and the incipient rise of protectionism. Recent geopolitical tensions signal an abrupt end to the “peace dividend,” and it’s fair to assume that defense spending is likely to increase adding further pressure to fiscal deficits.

- Demographic impacts on inflation are contentious amongst market prognosticators, but I suspect the continuation of the great retirement will have inflationary effects on the economy. Baby Boomers are currently the largest and wealthiest demographic cohort by far. It seems likely that Boomer demand for goods and services, especially healthcare, will remain strong despite the diminished workforce retirees leave behind. Boomer spending without contributing roughly similar economic productivity may drive up the cost of goods and services in real terms.

- Commodity prices are likely to increase in the coming decades leading directly to higher prices and weighing on economic growth and productivity. The demand for natural resources appears set to increase thanks to a rising standard of living in the emerging world, the developed world’s desire to transition to green technology and the massive infrastructure build out required to power artificial intelligence. These forces are conspiring after decades of underinvestment in crucial natural resources. The lead times to bring new supply on-line and the political unpopularity of resource extraction will likely result in a delayed supply response to rising demand meaning commodity prices are biased to go higher.

- Last year we introduced the idea of Fiscal Dominance here. History suggests that US debt and deficit levels may have crossed the point of no return as the effects of fiscal policies now swamp central bankers’ ability to titrate inflation via their monetary policy tools. The only obvious resolution to fiscal dominance is a significant and concurrent cut in entitlements and defense spending; something so unlikely and politically untenable as to be dismissed out of hand. This being the case, the most likely path forward for developed economies is ever more financial repression and currency debasement; two of the largest but least understood risks facing long-term investors.

The emerging macroeconomic backdrop is as uncertain as ever. “Hard landing,” “stagflation,” Mises’ “crack-up boom”; we have no way of knowing ex ante what the future holds for investors. That said, the odds seem stacked against a repeat of 40 more NICE years. The abovementioned evolution in structural forces will likely drive higher future volatility in both growth and inflation. Such elevated macroeconomic volatility necessitates a more balanced, dynamic approach to portfolio construction than the current “60/40,” “buy-and-hold” orthodoxy.

The Oxford Investment Fellows view asset classes through the lens of sensitivity to growth and inflation. Different asset classes have different response functions to rising or falling growth and inflation. Armed with an appreciation of these sensitivities, we seek to assemble asset allocations for clients with an eye towards balancing risk across assets and strategies meant to thrive in different macroeconomic regimes. Such portfolio balance, while often sub-optimal in any single state of the world, ensures robust compounding of capital across meaningful time frames. This more balanced approach sacrifices the chance of being “precisely right” in exchange for taking “precisely wrong” off the table, a prudent strategic framework in an uncertain world.

The information contained in this report is confidential and proprietary to Oxford and is provided solely for use by Oxford clients and prospective clients. The opinions expressed are those of Oxford Financial Group, Ltd. The opinions are as of date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. The information in this presentation is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. Tax and legal counsel should be engaged before taking any action. OFG-2406-10