“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” –Warren Buffett

Among Warren Buffett’s many insightful investment lessons, this is among the most important. The “weighing machine” reflects Buffett’s belief that assets, over the long-term, will reflect their fair value. The “voting machine” reference acknowledges the reality that market prices, in the short-term, are influenced by factors other than their fundamental value. Investors who are able to determine when prices diverge from fair value are able to both reduce risks and identify opportunities.

May’s Consumer Price Index came in above expectations at 8.6%, leading the Federal Reserve to increase the federal funds rate by 75bps. The prospect of the Fed further increasing interest rates in the face of slowing economic growth has resulted in a 22% drop in the S&P 500 from its high in early January. Investors are reassessing fair value for US stocks in light of an inflationary environment unlike any experienced in recent history.

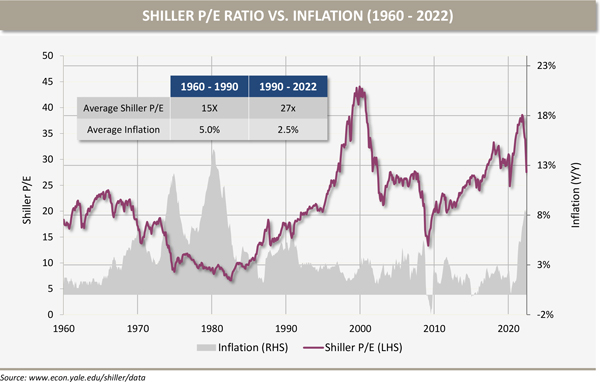

The US stock market valuation has traded at elevated levels relative to its long-term history for most of the past three decades. The average Shilller P/E Ratio has been 27x from 1990 to 2022, well above its average of 15x from 1960-1990 and its long-term average of 17x. The Shiller P/E looks at earnings over the prior 10 years, adjusted for inflation.

Several explanations have been offered for higher valuations in recent years:

The Fed Put

Put options provide investors with downside protection against losses. The Fed put refers to the belief that the Federal Reserve will step in to support asset prices when they fall. While the Federal Reserve does not have a mandate to support financial asset prices, the frequency with which they have stepped in to provide support has given market participants confidence to pay increasingly higher valuations. The Fed has had the flexibility to provide support because inflation, one of its key mandates, has remained tepid. Inflation since 1990 has averaged just 2.5%. That has clearly changed.

There Is No Alternative (TINA)

TINA is an acronym which stands for “There Is No Alternative.” With depressed rates on bonds due to accommodative policy and quantitative easing, investors have been willing to pay a higher price for equities. Some argue a lower discount rate on future cash flows should be used and thus, higher values are warranted; however, skeptics have warned against valuing long-term cash flow streams with lower discount rates as lower interest rates may not be sustainable.

Profit Margins

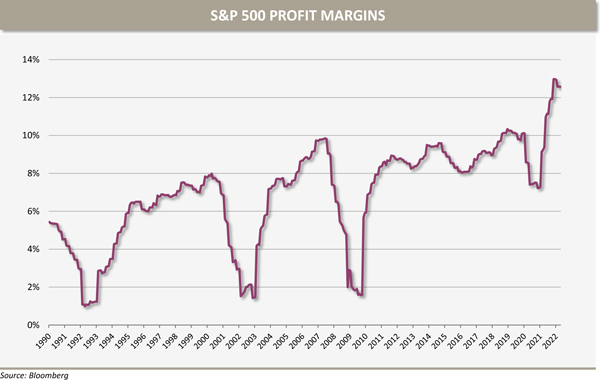

S&P 500 profit margins, while cyclical, have trended higher over time due to growth in higher-margin sectors such as technology and healthcare. Margin improvement has also been aided by lower interest rates, input costs and modest wage inflation. Post-pandemic profit margins skyrocketed to all-time highs as companies cut costs in anticipation of lower demand only to see sales accelerate in many areas supported by aggressive government stimulus programs.

https://ofgltd.com/wp-content/uploads/2022/06/600-Shiller-ePerspective-Charts-062822-2.jpg

A New Economic Regime

The extraordinary fiscal and monetary response to the global pandemic, combined with supply chain disruptions, resulted in a supply-demand imbalance which is driving inflation to levels not seen in over 40 years. The Russia/Ukraine conflict further exacerbated inflation pressures. Initially viewed as transitory, inflation is proving to be more durable than originally thought.

Stagflation has become a central concern as economic indicators point to rapidly decelerating economic activity with consumer confidence hitting record lows. As stock prices fall, investors are reassessing the value they are willing to pay for equities given the current environment. If inflation remains elevated, history would suggest valuations will come down. In this scenario, the Fed will likely be unable to support the market in a correction and, in fact, may need to continue to tighten policy to reduce demand. Good-bye Fed put. As interest rates rise, there is an increasingly attractive alternative to stocks. So long TINA.

Profit margins are likely to come under pressure as well due to a more cautious consumer, higher commodity prices and increased wage inflation. High debt levels and budget deficits make higher interest rates and tax rates a potentially longer-term headwind as well.

The Voting Machine

As always in market drawdowns, non-fundamental factors influence stock prices as well. The 100%+ gain from pandemic lows fueled investors’ confidence and increased their tolerance for risk. Speculative activity was rampant and margin debt soared. Prices benefited as a result. As markets correct, investors reduce their risk tolerance and margin calls accelerate the decline.

Another important influence on market prices has been the shift in market structure. Passive exposure has increased from less than 1% in the early 90s to nearly half the domestic market today. Passive funds have received the majority of the inflows while active management has declined. One of the more important implications of this change is that the market has become more sensitive to changes in fundamentals. Moves to both the upside and downside have become more extreme. Active managers, in aggregate, are typically sellers as stocks rise above their value and buyers of stocks as they come down. With fewer active managers to step in, market moves have become more exaggerated on both the up and down side. When market corrections occur, the declines tend to happen quickly. Such was the case in 2018, 2020 and this year. In all three instances, we witnessed drawdowns of 20%+ in a matter of weeks.

After a long period of disinflationary growth, a period of stagflation appears to be a higher probability scenario. At Oxford, we strive to construct portfolios that are resilient to a range of economic outcomes. We believe diversifiers and real assets provide portfolio stability in a high-inflation environment, which is a challenging environment for a traditional stock and bond portfolio. While international markets face many of the same economic challenges as the US market, valuations have also discounted these concerns more aggressively. Indiscriminate selling during market corrections drives volatility and dislocations between prices and fair value. For active investors focused on weighing assets but cognizant of the factors driving the pricing machine, these dislocations are opportunities to add value to portfolios.

<em><small>The above commentary represents the opinions of the author as of 6.30.22 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements. OFG-2206-11</em></small>