Famed American economist and Nobel Laureate Milton Friedman often said that monetary policy works with “long and variable lags.” Conventional wisdom is that the effects of monetary tightening are most acutely felt 12-18 months after the start of a central bank rate hiking cycle. We are now in month 17 of the current hiking cycle and inflation appears set to reaccelerate in the coming months. What gives? Has monetary policy lost some of its efficacy?

The idea of fiscal dominance suggests that the answer may be “yes.” This article attempts to introduce the concept of fiscal dominance, why the 2020s may differ from previous rate cycles and what it all may mean for investors.

Fiscal Dominance

Fiscal dominance is an economic condition that occurs when a country’s debt and deficit levels are sufficiently high that monetary policy ceases to be an effective tool for controlling inflation. In fact, persistently high interest rates in an environment of perpetually large deficits actually risks exacerbating inflation.

To understand the concept of fiscal dominance, it makes sense to revisit how money gets created in the first place. The two main drivers of money creation are:

- The expansion of bank credit (i.e., new money being lent into existence via fractional-reserve banking)

- Monetized fiscal deficits (i.e., “printing” money to fund government spending)

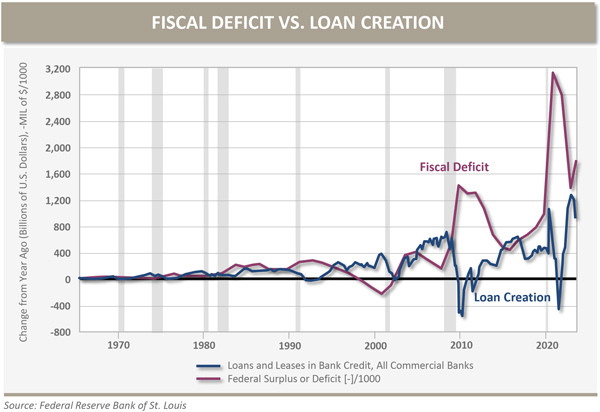

Higher policy rates are effective at curtailing bank credit, which has a disinflationary cooling effect on the economy. However, higher policy rates increases debt service costs leading to a rise in government deficits, which triggers the need for further inflationary “printing.” If the source of inflation is more deficit-driven, then higher interest rates won’t solve the problem.

Why the 2020s May Differ from Previous Rate Cycles

The recent bout of inflation is primarily attributable to deficit-driven fiscal stimulus post-COVID, which has far outweighed bank credit creation in recent years. This means that the core problem is the deficit, and the Fed is using their 1970s playbook to fight a 1940s problem. Said more explicitly, higher rates might be compounding the inflation problem this time around.

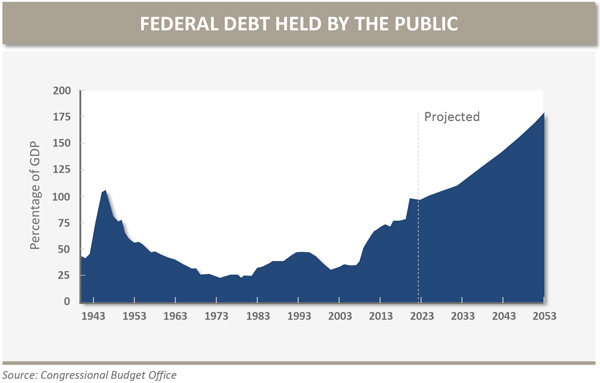

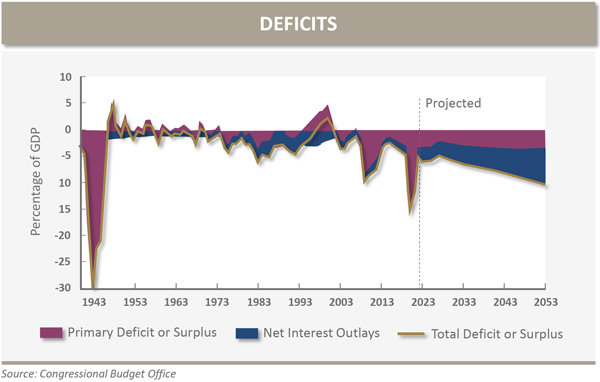

Monetary history is littered with examples of countries that experienced deficit-driven inflationary spirals with Argentina being the canonical case. Government debt exceeding 100% of GDP appears to be the point at which the efficacy of monetary policy degrades and fiscal policy begins to dominate inflationary outcomes. As of this writing the US debt-to-GDP ratio stands at 119%, and never before has our fiscal deficit been so high at a time of such low unemployment. With cuts to entitlement spending being the ultimate third-rail of politics, the deficit seems destined to expand further should the economy weaken causing social safety nets to kick in at a time of reduced tax revenues. The below charts from the Congressional Budget Office visually show some concerning projections.

The saving grace thus far for the US has been the dollar’s role as the primary reserve currency of the world. However, recent geopolitical events suggest that the dollar’s reign may be set to gradually erode as major commodity-producing nations seek to establish trade in alternative currencies. Regardless, the external demand for US Treasurys is likely to be insufficient to fund the government, meaning monetized deficit spending will be with us for the foreseeable future.

What it All May Mean for Investors

I commend anyone that has made it this far on such a wonky topic. Now the payoff: what might all this mean for investors, particularly stewards of multigenerational wealth? History suggests that US investors are likely to experience persistently above-target inflation, more pronounced cycles of inflation and stagnation and higher currency volatility than we’ve become accustomed to. History also suggests that policymakers will attempt to assuage the problem by managing the yield curve, thus subjecting investors to negative real rates of interest, sometimes referred to as “financial repression.”

The Oxford Investment Fellows℠, informed by a deep appreciation of global market history, have considered the above in our approach to portfolio construction on behalf of our clients. We strive to build robust investment portfolios capable of preserving real wealth regardless of the vicissitudes of any given market. Specifically, the current situation, as much as ever, warrants inclusion of equity investments in high quality businesses with strong moats and pricing power (both public and private). A potential secular decline in the US Dollar strongly supports diversifying equity holdings internationally as well. A pro-inflationary environment also demands investing capital in real assets such as real estate, commodities and commodity producers and neutral reserve assets such as gold. A prolonged period of financial repression significantly dampens the appeal of traditional “safety” assets, such as Treasury bonds, requiring investors to seek alternative forms of portfolio ballast. Such alternatives might include Diversifier Strategies which stand to benefit from elevated volatility and may offer a valuable source of countercyclical liquidity.

When debt levels and deficits approach the point of no return, the familiar policy playbook may no longer apply. In a condition of fiscal dominance, stewards of capital are right to turn to history for guidance and take a fresh look at their portfolios.

The information in this presentation is for educational and illustrative purposes only and does not constitute tax, legal or investment advice. Tax and legal counsel should be engaged before taking any action. Oxford Financial Group, Ltd. is an investment advisor registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Oxford Financial Group’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. The above commentary represents the opinions of the author as of 8.9.23 and are subject to change at any time due to market or economic conditions or other factors. The information above is for educational and illustrative purposes only and does not constitute investment, tax or legal advice. No offers to sell, nor solicitation of offers to buy any securities are made hereby. Solicitations of investments and any offers to sell securities, if any, will be made only through an offering document clearly identified as such. Certain of the statements in this document are forward‐looking which cannot be guaranteed. These statements are based on current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results or future performance to differ materially from those expressed or implied in such statements.OFG-2306-12